The US Dollar and how it works

The United States Dollar (USD) is the official currency of the United States of America. It is the most widely used currency in the world and is also known as the American Dollar. The symbol used to represent the US Dollar is "$" and its international reference code (ISO code) is USD. The US Dollar is used as the standard currency for global trade and finance, and it is also employed as a reserve currency by several countries around the world. The Federal Reserve System, also known as the Fed, is responsible for issuing and controlling the US Dollar.

- The U.S. dollar as a currency of global importance

- Quotation of the U.S. dollar against major foreign currencies

- Reference interest rate of the Federal Reserve Bank of New York

- Effective Federal Funds Rate

- Overnight Bank Funding Rate

- The SOFR rate: what it is and how much it corresponds to

The U.S. dollar as a currency of global importance

When it is stated that the US Dollar is used as a reference currency for global trade and finance, it refers to the fact that the USD is commonly used as a medium of exchange for international transactions between different countries. This means that when two countries need to carry out commercial or financial transactions with each other, they often use the American Dollar to complete the purchase of goods and/or services, to settle international debts, and to make investments. The main reasons why the American Dollar has been chosen as the reference currency for international trade are the stability that the Dollar has as a legal currency and the strength of the US economy.

In addition to what was written above regarding the adoption of the US Dollar as the reference currency for global trade, it is worth adding that many commodities such as oil, gas, gold, and other natural resources are priced in USD in various global stock exchanges. This only reinforces the position of the American Dollar as the standard currency for global trade.

The US Dollar was first recognized as legal currency with the Coinage Act of 1792. Since that date, there have been several legal modifications. Among the most important are those of January 18, 1837, which established its weight in silver, namely 26.730 grams. On March 3, 1849, the minting of the gold dollar of 1.67185 grams was authorized, containing 1.504665 grams of pure gold. An act of February 12, 1873, authorized the minting of a silver trade dollar, weighing 27.216 grams. The silver trade dollar was abolished in 1876. With the act of March 14, 1900, the gold dollar was declared the official monetary unit of the United States of America. Nowadays, the dollar has several coins made of gold and silver. Gold pieces are minted in denominations of $20 (double eagles), $10 (eagles), $5 (half-eagles), and $2.5 (quarter-eagles). Silver pieces are minted in denominations of $1, 50 cents, 25 cents, and 10 cents (dime). The dollar is divided into 100 cents, which are minted in nickel (5 cents) and copper (1 cent) coins. Banknotes are issued in denominations of $1, $2, $5, $10, $20, $50, $100, $500, $1000, and $10,000.

of the U.S. dollar quotation against major foreign currencies

| CHF | EUR | USD | GBP | JPY | CAD | AUD | |

|---|---|---|---|---|---|---|---|

| CHF | 1 | 1.0215 | 1.0922 | 0.8778 | 169.8168 | 1.5022 | 1.6993 |

| EUR | 0.9715 | 1 | 1.0650 | 0.8554 | 165.1721 | 1.4612 | 1.6529 |

| USD | 0.9056 | 0.9295 | 1 | 0.7984 | 154.7880 | 1.3703 | 1.5495 |

| GBP | 1.1298 | 1.1589 | 1.2407 | 1 | 191.7744 | 1.6965 | 1.9195 |

| JPY | 0.0059 | 0.0061 | 0.0065 | 0.0052 | 1 | 0.0088 | 0.0100 |

| CAD | 0.6657 | 0.6844 | 0.7301 | 0.5894 | 113.0492 | 1 | 1.1312 |

| AUD | 0.5885 | 0.6050 | 0.6454 | 0.5209 | 99.9348 | 0.8840 | 1 |

Interest rate benchmark of the Federal Reserve Bank of New York

What is the interest rate benchmark of the Federal Reserve Bank of New York and what is its purpose?

The production of various reference rates by the Federal Reserve Bank of New York is essential in providing valuable insights into the behavior of money markets, allowing for an evaluation of the effectiveness of implementing monetary policies. In financial markets, reference rates play multiple critical roles in maintaining market efficiency. They facilitate the trading of standardized contracts, thereby reducing transaction costs and improving market liquidity. Additionally, they mitigate information asymmetries by providing a transparent and independent pricing source. A well-designed and robust reference rate that cannot be manipulated can discourage market players from providing inaccurate pricing information when settling a contract.

The Federal Reserve Bank of New York computes the Effective Federal Funds Rate (EFFR) and the Overnight Bank Funding Rate (OBFR) by utilizing transaction data reported daily under the governance of the Board of Governors of the Federal Reserve System.

Additional Information about Reference Rates Administered by the New York Fed.

Effective Federal Funds Rate

The federal funds market refers to the unsecured overnight borrowings in U.S. dollars that depository institutions and some other entities, such as government-sponsored enterprises, make from other depository institutions. The Effective Federal Funds Rate (EFFR) is calculated by the New York Fed as a volume-weighted median of overnight federal funds transactions reported in the FR 2420 Report of Selected Money Market Rates. The New York Fed publishes the EFFR on its website around 9:00 a.m. for the previous business day. The Federal Open Market Committee sets the target rate or range for trading in the federal funds market.

Overnight Bank Funding Rate

The Overnight Bank Funding Rate (OBFR) reflects the cost of unsecured, overnight bank funding in the wholesale market. To compute the OBFR, the New York Fed uses transaction data reported in theReport of Selected Money Market Rates, which includes federal funds transactions, certain Eurodollar transactions, and specific domestic deposit transactions. The federal funds market is composed of unsecured borrowings in U.S. dollars by depository institutions and other entities like government-sponsored enterprises. The Eurodollar market is made up of unsecured U.S. dollar deposits held at banks or bank branches located outside of the United States, while U.S.-based banks can take Eurodollar deposits domestically through international banking facilities (IBFs). The OBFR also covers U.S. dollar deposits with a fixed overnight term and a negotiated interest rate booked in U.S. offices of banks, reported as "Selected Deposits". The OBFR is the volume-weighted median of overnight federal funds transactions, Eurodollar transactions, and domestic deposits reported as "Selected Deposits", and it is published on the New York Fed's website at approximately 9:00 a.m. for the previous business day.

Below you can find the Federal Reserve Bank of New York's benchmark interest rate, with an indication of when it was last updated.

| Reference institution |

|---|

| Federal Reserve Bank of New York, United estates of America |

| Headquarter |

| New York, United estates of America |

| Reference interest rate |

| 5.500 % |

| Last update |

| 07-26-2023 |

The SOFR rate: what is it and how much does it correspond to?

The London Interbank Offered Rate (LIBOR), which has been the primary benchmark for interest rates for credit agreements since the 1980s, is being replaced by the Secured Overnight Financing Rate (SOFR), a benchmark interest rate for dollar-denominated derivatives and loans. After the 2008 financial crisis, the reliability of LIBOR was called into question when it was discovered that some banks were manipulating the rate for their own benefit. As a result, the British regulator in charge of compiling LIBOR rates announced that they would stop requiring interbank lending information after 2021, leading to the search for a new benchmark. The Federal Reserve formed a committee to select a replacement, ultimately choosing the SOFR for dollar-denominated contracts. As of October 2020, interest rate swaps on over $80 trillion in notional debt have transitioned to the SOFR. While this change is expected to increase long-term liquidity, it may also result in substantial short-term trading volatility in derivatives.

The SOFR is an interest rate benchmark that banks use to price loans and derivatives in U.S. dollars. Calculated daily, the rate is derived from transactions in the Treasury repurchase market, where banks borrow overnight funds by putting up their bond holdings as collateral. One example of a derivative contract that uses the SOFR is an interest-rate swap, which involves two parties agreeing to exchange fixed and floating interest payments. The floating leg of the swap is based on the SOFR, which may be higher or lower than the fixed leg depending on market conditions and the creditworthiness of the parties. When interest rates rise, the party paying the floating rate benefits as the value of incoming payments increases, while the cost of fixed payments remains constant. Conversely, when interest rates fall, the opposite occurs.

The Federal Reserve declared on Nov. 30, 2020 that LIBOR, the primary benchmark for interest rates for credit agreements since the 1980s, would be phased out and replaced by June 2023. Banks were advised to halt writing contracts that use LIBOR by the end of 2021, and all contracts using LIBOR should be completed by June 30, 2023. The transition from LIBOR to SOFR is a challenging task because trillions of dollars worth of contracts are tied to LIBOR, including the widely used three-month U.S. dollar LIBOR. There are significant differences between the two rates, such as LIBOR representing unsecured loans, while SOFR represents loans backed by T-bonds. The transition to SOFR will have a significant impact on the derivatives market but will also affect consumer credit products and debt instruments like adjustable-rate mortgages and commercial paper. Homeowners who have adjustable-rate mortgages based on SOFR will see their interest rates fluctuate depending on the benchmark rate.

Below you will find the latest updated value of the SOFR rate at different maturities:

| SOFR | 5.310 % |

| SOFR 30 day average | 5.330 % |

| SOFR 90 day average | 5.348 % |

| SOFR 180 day average | 5.390 % |

Need to change your money and want to take advantage of our extremely advantageous exchange rates? Sign in by clicking on the button below.

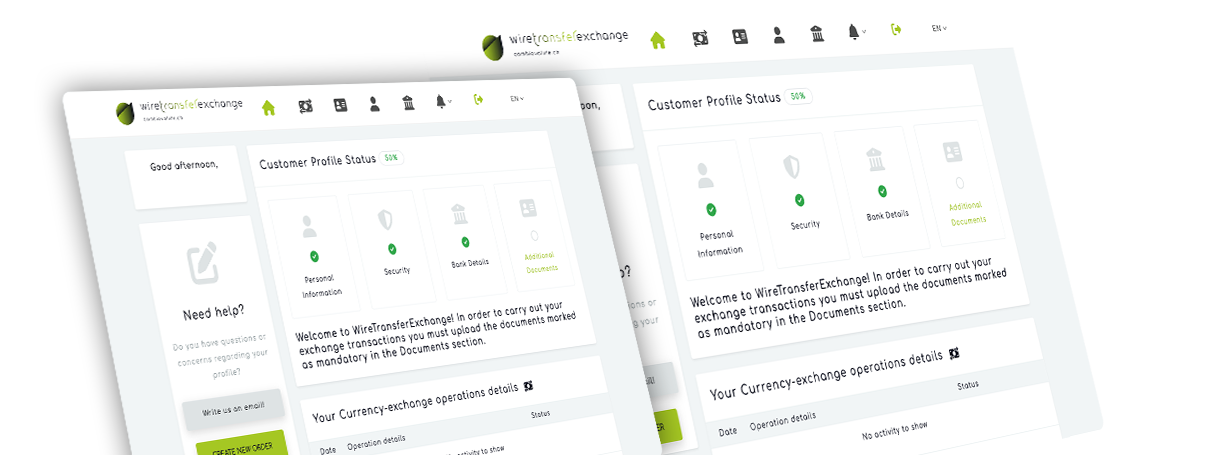

CHANGE NOW AND FIND OUT HOW CONVENIENT IT IS !Why choose Wiretransferexchange.com?

With Wiretransferexchange.com you change your money, salary or savings from the comfort of home and save up to 80% compared to the average rates of traditional banks and exchanges. Find out why it makes sense to change with us if you are a cross-border commuter, resident in Switzerland or a company.

Register now