PROCEDURE

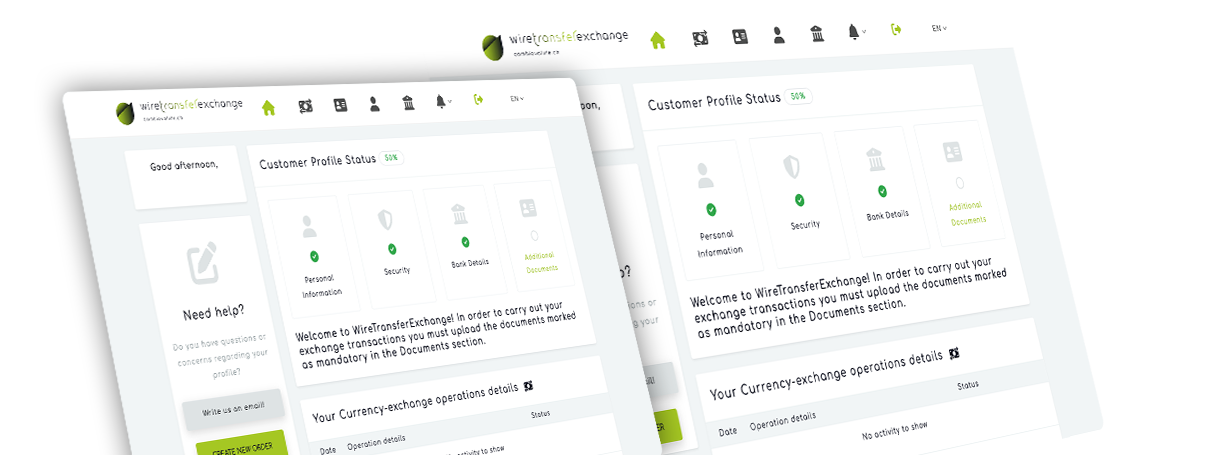

- Login to your user profile.

- Go to: Menu > Documents.

- Download, fill out, and send us the following documents:

- Customer Profile;

- Form A;

- Proof of funds (POF) (payslip, employment contract, or other).

- Schedule your video identification.

For any currency exchange transaction:

- Identity document (ID card or Passport).

- For non-Swiss citizens, a work permit or residency permit.

- Customer Profile;

- Form A;

Yes. If required, you can send us a copy of your work permit when you receive it.

No. ELP SA - Wiretransferexchange.com does not accept or pay out in cash.

Swiss Francs (CHF), Euros (EUR), US Dollars (USD), and British Pounds (GBP).

The exchange rate you lock in remains fixed until 7:00 PM CET on the following banking day, based on when you made the request. If your transfer arrives after this time, we'll use the exchange rate in effect when we receive your funds for exchange.

Yes. Exchange rates are fixed until the next banking day, excluding weekends and bank holidays.

Yes, it's possible. These will be considered linked operations, so you'll be required to verify your identity and send the necessary documents for exchanges exceeding CHF 5,000.

For occasional cases or genuine errors, no action will be taken. However, if there are multiple unfulfilled requests or cases of bad faith, the client's use of our exchange service will be restricted.

If your exchange request expires but you've still sent the funds to be exchanged, we will still process the exchange on your behalf. We will create a new exchange request using the same bank details as the recently expired one, but we will update the exchange rate with the rate available at the time we receive the funds to be exchanged.

The service operates exclusively through bank transfers.

You must have an account denominated in the original currency and another account denominated in the destination currency. For example, to exchange CHF to Euro, you need an account in Swiss Francs and another in Euros.

You cannot:

- Send money to third parties or pay bills through Wiretransferexchange.com;

- Exchange cash;

- Make withdrawals or deposits at our offices.

The company does not cover the costs charged to the client by their bank.

The booked and fixed exchange rate is valid until the end of the next banking business day after the request.

There's a CHF 20 fee for any manual changes made or to be made to the exchange transaction.

James, an employee at ABC Sagl company, has two bank accounts—one in CHF in Switzerland and another in EUR, both under his name. He needs to exchange 2,000 CHF into EUR for a vacation in Italy.

James subscribes to http://www.Wiretransferexchange.com/. As part of the process, James must upload copies of both sides of his identification document prior to the first exchange. To initiate the exchange, James completes the exchange request form. Upon submission, he promptly receives an email confirmation along with the bank details for his CHF transfer.

He completes the CHF transfer as instructed and awaits confirmation. Within 24 hours, he receives an email from contact@Wiretransferexchange.com, confirming receipt of his transfer and the conversion of funds into Euros. He's informed that within 48 hours, he'll receive the equivalent Euros in his EUR account.

Shortly after, James finds the Euro amount deposited into his Euro bank account. Remarkably, he discovers that he has received at least 20 Euros more than the exchange rate offered by his Swiss bank.

Yes. To use Wiretransferexchange.com, you need to have a bank account denominated in the original currency and another bank account denominated in the destination currency. For example, to exchange CHF to Euro, you need a bank account in CHF and another in Euro.

Usually, the day after you send your funds. Timing also depends on your bank. Wiretransferexchange.com will send you the money in the requested currency on the same day it receives your funds.

Yes, register and upload all the required documents in your personal area. Video identification will also be required. You will receive an email confirming the activation of your profile for exchanges without amount limits

Yes, register and upload all the required documents in your personal area. Video identification will also be required. You will receive an email confirming the activation of your profile for exchanges without amount limits.

Yes, you can modify it via email or by phone. Please note that a CHF 20 fee will be charged for manual changes to your exchange order.

No, both the sender and the recipient of the money must be the same person.

No, both the sender and the recipient of the money must be the same person.

There are several ways to certify your identity:

- Complete the video identification procedure. It's free and takes about 5 minutes. This is the recommended method;

- Send us a notarized/certified copy of your identification document by mail. You can request a certified copy of your document at the bank, at Swiss Post, at the municipality, from your lawyer/notary, or from your trustee. The copy must contain the date, signature, and contact details of the person who certified the document; By appointment, visit our office in Chiasso with a valid identification document.

Yes, your company can use the service. Register and follow the required procedure for the corporate profile.

No, Wiretransferexchange.com does not deal with crypto assets.

No, for security and traceability reasons, Wiretransferexchange.com only works with bank transfers. We do not accept or pay out cash.

No, for security and traceability reasons, Wiretransferexchange.com only works with bank transfers. We do not accept or pay out cash.

No, after creating a customer profile and submitting an exchange request, you need to send us the money to be exchanged via bank transfer. Wiretransferexchange.com (ELP SA) cannot withdraw money from your bank account or instruct payments on your behalf. If you wish to exchange automatically and effortlessly, you can use the Recurring Exchange service by setting up a recurring bank transfer with your bank.

Yes, you can set up the Recurring Exchange service by instructing a recurring bank transfer with your bank.

TRANSFERS

The cost for sending the exchanged money is borne by Wiretransferexchange.com. We will send the money in the requested currency and to the specified account without applying any transfer fees.

Please note:

- The cost of sending money to Wiretransferexchange.com is your responsibility. Typically, this is done through a free Swiss national payment for the client.

- We will only exchange the money that has actually arrived at Wiretransferexchange.com;

- Your bank may charge you fees for receiving/sending transfers. Please check the conditions applied by your bank.

You need to send us the money to be exchanged via a normal bank transfer. We recommend using the SEPA system for EUR transfers and instructing a Swiss national payment for CHF transfers.

For euros, we will send you a SEPA transfer. In the case of an exchange to Swiss Francs, we will send you a Swiss national payment. For other currencies, we will instruct a SWIFT payment on your behalf.

Please note: some banks may apply a fee for receiving the transfer. Check with your bank.

If you make a mistake in instructing the transfer to ELP SA, the bank will reject the payment, and the money will automatically return to your account. The reimbursement process may take up to 5 working days, depending on your bank.

AMOUNTS

The minimum exchange amount is 100 CHF or its equivalent in other currencies.

The maximum exchange amount is 1,000,000 CHF or its equivalent for a single transaction.

COSTS AND FEES

Wiretransferexchange.com offers customers the best possible exchange rate, updated in real-time. We add a small spread (our commission) to the interbank exchange rate, always consistent and transparent. You can find details on the "Costs" page.

Wiretransferexchange.com offers the best possible exchange rate to all customers, regardless of the amount exchanged. Contact us for exchanges exceeding CHF 1 million or equivalent.

No. We do not apply any exchange fees. We will exchange your money at the rate proposed in our conversion form.

Wiretransferexchange.com does not charge commission for your exchange transactions. The company's profit margin comes from the difference between the currency acquisition cost and the price at which the same currency is offered to the public. Wiretransferexchange.com purchases a large quantity of currency wholesale and then resells it at a slightly higher price on the retail market. In the currency exchange market, the wholesale price is also known as the interbank rate. You can also see the markups applied by Wiretransferexchange.com on the Costs page.

In our experience, here's the cost of exchanging 1,000 CHF into Euros:

- International airport exchanges: 70 CHF

- Prestigious bank: 20 CHF

- foreign exchange counter: 10 CHF

- Wiretransferexchange.com: 3.5 CHF

Our team comprises professionals with extensive experience in the financial sector and currency trading (ForEx). We tap into the liquidity of the international interbank market and purchase large quantities of currency daily to offer you the best possible exchange rates.

SECURITY

Yes. The currency exchange service is provided by the company ELP SA. ELP SA is a regulated financial company in Switzerland headquartered in Chiasso. Our team consists of professionals with extensive experience in the financial sector and currency trading (ForEx), and we exclusively use banks and financial intermediaries that are market leaders in the financial industry.

Yes. Wiretransferexchange.com services are provided by ELP SA, a regulated company in Switzerland authorized for currency exchange activities. For more information, visit https://wiretransferexchange.com/en/regulation/

PROMOTIONS

Yes. Please visit https://wiretransferexchange.com/en/promotions/

COLLABORATIONS

Yes. We'll reward you with a bonus. Please visit https://wiretransferexchange.com/en/promotions/

Yes, visit our Promotions page..

Yes. Contact us to propose any collaborations. Our job openings are posted on https://wiretransferexchange.com/en/careers/

DATA AND PRIVACY

Your data and those related to your transactions are stored electronically and as paper documents at our headquarters. In compliance with legal regulations, we stored the data for a period of 10 years.

ELP SA operates according to Swiss law.

PROBLEMS AND SOLUTIONS

Please check that:

- You have entered your correct email address;

- Your inbox is not full;

- The spam or junk mail folder.

Check with your bank to ensure that the funds to be exchanged have been sent to the correct bank details. If you have not received our confirmation email within 24 hours of sending your transfer, please contact us. Don't worry, bank transfers cannot be 'lost.'

Yes, simply do not proceed with the bank transfer. If it's a mistake or an error, there's no problem. However, if you repeatedly fail to follow through with your exchange requests or if there's misuse of the service, your profile will be banned from using Wiretransferexchange.com.

Write to us at contact@Wiretransferexchange.com, and we will be happy to find a solution. If you are not satisfied, you can contact the self-regulatory association we adhere to at www.polyreg.ch or submit a complaint through the dedicated form available on the website www.finma.ch.

WHEN TO EXCHANGE AND FORECAST EURO-SWISS FRANC

It's not possible to predict future exchange rates. Nor is it possible to predict the performance of financial instruments, including exchange rates.However, there are specialized software programs capable of analyzing historical data and the seasonality of various assets. For example, forecaster.biz.

No one can predict the future, especially financial markets. However, there are specialized software programs capable of analyzing historical data and the seasonality of various assets. For example, forecaster.biz.

Why choose Wiretransferexchange.com?

With Wiretransferexchange.com you change your money, salary or savings from the comfort of home and save up to 80% compared to the average rates of traditional banks and exchanges. Find out why it makes sense to change with us if you are a cross-border commuter, resident in Switzerland or a company.

Register now