Guide for cross-border workers

Get the most out of your work in Switzerland!

This short guide aims to provide useful information and links to official and governmental sites for the border worker. The topics covered are derived from the most frequently asked questions by users of CambiaValute.ch on the most common topics related to border work, economics and law.

If you are looking for a job, we recommend reading our guide to finding a job in Switzerland.

INDICE:

- Get the most out of your work in Switzerland!

- The employment contract in Switzerland

- The Swiss work permit

- The card - nothing to declare and fast track for cross-border commuters

- Trade Unions in Switzerland

- The minimum wage in Switzerland

- Unemployment insurance

- Pensions: the 'pillars'

- Frontier workers and taxes. What is withholding tax?

- What is the border strip?

- Does a cross-border commuter have to pay health insurance in Switzerland?

- The taxation of cross-border commuters. New in the agreement between Switzerland and Italy of 23 December 2020.

- The difference between 'old frontier workers' and 'new frontier workers'.

- Bank: CHF account and EUR account

- Changing your currency from CHF to EUR. How to change your salary into euros

- The transfer from the Swiss account to the European account.

- The mobile phone. Which company allows me to have roaming to and from Switzerland included in the offer?

- The vignette for the motorway in Switzerland.

- Is it possible to apply for a mortgage in Switzerland to buy a house in Europe?

Swiss Confederation, customs, border and Schengen area

Switzerland (CH) is divided into three major language regions: German, French and Italian. The national currency is the Swiss Franc, abbreviated to CHF. The real time exchange rate is published on WireTransferExchange.com and it is possible to change CHF into EUR and vice versa.

The Swiss Confederation is a member of the United Nations, the European Free Trade Association (EFTA), the Council of Europe, and the World Trade Organisation.

The Confederation joined the Schengen area on 12 December 2008. Since then there is no longer any border control for persons, while controls for goods have been maintained.

For more information:

- Switzerland: Federal Customs Administration: https://www.ezv.admin.ch/ezv/it/home.html

The employment contract in Switzerland

The employment contract in Switzerland is governed by Title Ten of the Code of Obligations. The entire updated body of law can be viewed or downloaded in PDF format at this address.

Here are the highlights of what the law provides for:

- Weekly working time: 40 hours (or less, if the contract is part-time)

- Holidays: the employee is entitled to four weeks' holiday (20 working days) per calendar year. This number may be higher, if the company allows it

-

Termination of employment:

- 1 month if the employment relationship lasted less than 1 year

- 2 months if the duration was between 1 and 9 years

- 3 months if the duration is more than 10 years.

- Probationary period: maximum three months, with 7 days' notice of termination

Types of employment contracts in Switzerland

There are three types of employment contract:

1. Individual employment contract: regulates rights and duties of workers and employers. It is not subject to any formal requirements.:

2. Collective labour agreements (CCL): concluded between employers' and workers' associations.

3. Standard employment contracts (CNL): these are regulatory acts of the Confederation or the cantons and regulate labour relations by means of provisions on working hours, holidays, termination periods, etc.

For more information, please visit the government website: https://www.ch.ch/en/work/employment-contract-and-collective-agreements/

WireTransferExchange.ch, to fulfil its legal obligations, in particular in accordance with the: Federal Law on Combating Money Laundering and Terrorist Financing, may ask you for a copy of your employment contract or a copy of your latest pay slips.

The Swiss work permit

If you are not a Swiss citizen (you do not have a Swiss passport), you need a work permit to work in Switzerland. The reference authority is usually the Office for Migration, which issues work permits. Here is the official reference site: https://www.sem.admin.ch/sem/en/home/themen.html

List of main classes of permits for foreign nationals:

Permit G (for cross-border commuters): For foreign nationals who intend to work in Switzerland without transferring their residence to the Confederation. More info: https://www.sem.admin.ch/sem/en/home/themen/aufenthalt/eu_efta/ausweis_g_eu_efta.html

Permit B (residence permit): For foreign nationals intending to settle in Switzerland on

Permit C (settlement permit): For persons who have lived in Switzerland for 5 or 10 years. More info: https://www.sem.admin.ch/sem/en/home/themen/aufenthalt/eu_efta/ausweis_c_eu_efta.html

WireTransferExchange.ch may ask you for a copy of your work permit in order to fulfil its legal obligations.

The card - 'Nothing to declare' and fast track for border crossers

Some customs have set up a fast lane for border workers. This lane can be used by displaying a special free coupon on the dashboard, which can be obtained from the border police.

Fast lanes are only active on working days, from 4 p.m. to 7 p.m., and can only be used under specific conditions:

Anyone who displays his card and uses the reserved lane is self-certifying that he is a border worker. You may also take other cross-border commuters in your car as long as they all have work permits. If you are transporting non-frontier workers, you cannot display the card and use the fast lane

Pensions: the 'pillars'

The social security system in Switzerland is very different from that in Italy. In the Confederation, in fact, the three 'pillar' structure is in force.

But what are these pillars? They are basically 3 contribution bands which, when added together, will then form the pension or social security cover in old age or in the event of death or disability.

The three pillars are defined as follows:

-

1st pillar. It is equivalent to state social security and is designed to guarantee minimum support for everyday life. It is compulsory and anyone who works and lives in Switzerland must contribute to the 1st pillar.

It includes:- Disability insurance (OASI/DI),

- Compensation for loss of earnings and maternity (EOI),

- unemployment insurance (AD),

- Supplementary Benefits (PC).

-

2nd pillar. This is the occupational pension plan (BVG, also known as 'pension fund') and is designed so that the taxpayer's standard of living does not have to change once he or she stops working. Its payment is compulsory.

Includes:- Occupational pension plan (BVG),

- Accident insurance,

- Daily sickness allowance,

-

3rd pillar. This is the private pension that the worker can build up to ensure an even 'quieter' old age, with a standard of living similar to that before retirement.

It consists of:- Restricted pension 3a. Capital that remains tied up for the long term and allows tax savings. Early withdrawals are only possible under special conditions;

- Unrestricted pension plan 3b. Capital that remains unencumbered in the long term, free from legal restrictions on deposits, surrender and availability (the minimum duration is usually agreed in the contract).

- Restricted pension 3a. Capital that remains tied up for the long term and allows tax savings. Early withdrawals are only possible under special conditions;

More information can be found in the three-pillar section on the Swiss Confederation's website.

Cross-border commuters and taxes. What is Withholding Tax?

In the case of frontier workers, withholding tax is a deduction from wages that the employer makes and pays to the Swiss tax authorities. It is a tax that affects those who work in Switzerland but do not have a settlement permit (C permit): in essence, border workers or workers who have tax residence in Switzerland (with a B or L permit) but have not yet fulfilled the requirements for a settlement permit.

It is therefore up to the employer to register the withholding tax at the relevant tax office where the employee lives in Switzerland and, if a cross-border commuter, at the office of the place of work.

The employer must also calculate the withholding tax and deduct it from the employee's monthly salary, also showing the deduction on the salary calculation and salary certificate.

The calculation of withholding tax.

Withholding tax is calculated by means of rates and varies from canton to canton.

For Ticino, a practical withholding tax calculator provided by the canton is available at this address.

Does a cross-border commuter have to pay health insurance in Switzerland?

Yes, health insurance is compulsory in Switzerland for everyone who works there (including family members who receive no income).

Frontier workers with a G permit are obliged to take out insurance from the beginning of their employment contract and have three months to join a Swiss health insurance fund.

Those who go beyond this period without valid justification may be automatically affiliated with a health insurance fund and must pay a supplement, as well as paying for any medical treatment until affiliation.

However, there are special agreements (Right of option) that allow cross-border commuters to take out insurance in their country of residence.

More information is available on the website of the Federal Office of Public Health.

Bank: CHF account and EUR account

A frontier worker regularly employed in Switzerland usually needs an account with a Swiss institution, a Swiss franc account, in order to receive a salary credit. In particular, the Swiss account is used to obtain a Swiss IBAN to communicate to one's employer.

This applies to most cases of frontier work. There are many banks that offer low-cost solutions, precisely to meet the needs of workers who cross the border into Switzerland every day for work purposes.

The cross-border worker usually does nothing more than exchange Swiss francs for euros and then transfer them to his account in his country of residence.

The most sought-after features of these 'back-up' accounts (also known as 'salary' accounts) are low maintenance fees and the absence of fees and surcharges. Credit or debit cards may or may not be included, but for the cross-border commuter it makes little difference.

Changing your currency from CHF to EUR. How to change your salary into euros

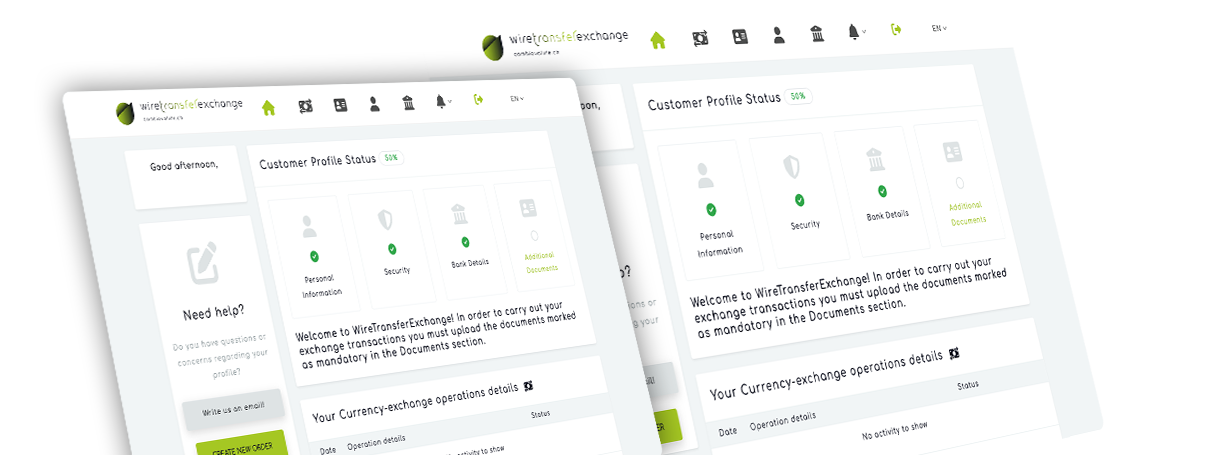

To change CHF to EUR There are several solutions, but the most convenient one, with no charges and an extremely advantageous rate, is certainly WireTransferExchange.com.

Why? Find out for yourself in the short video below and read here why you should change with us if you are a Swiss resident, a cross-border commuter, or a company.

Compared to traditional exchange solutions, online exchange offers several advantages:

- It's safe: you don't have to physically carry money, everything is done via wire transfers

- It's fast: it's often no more than 24-48 hours before you receive the money exchanged

- It is convenient: you do it from home or from the phone... how and when you prefer. No queues at counters

- It's convenient: commissions are zero and you see immediately how much you will receive in EUR

Withdrawing cash and going to exchange offices is another classic option, but this involves time-consuming and having to carry a considerable amount of currency with you.

If we think of recent history, then, in the case of lockdowns or other restrictive measures, going to a bank counter can be complicated.

Read why to change with WireTransferExchange.ch if you are a border-crosser.

The transfer from Swiss to European account

Although Switzerland is part of the SEPA area, a credit transfer to and from the Confederation is not treated like a domestic transfer because, precisely, we are not within the European Union.

The SEPA, Single Euro Payments Area, is an area set up by the EU itself, within which all credit transfers below 50,000 euros are standardised as payment types and, in terms of fees, are treated like a national transfer by the participating states.

As mentioned, Switzerland is a member of the SEPA area, but its being outside the EU means that some banks charge fees on the transfer as if it were a non-SEPA transaction. Each bank is its own story and there are no common regulations in this respect.

If you make a transfer in Francs to an Italian Euro account, there will be commissions: on the transfer, of course, but also on the currency exchange.

There may also be over-the-counter commissions if the transfer is made from that channel and, in the case of currency conversion, it must be taken into account that the exchange rate will be that of the end of the day, not that of the preparation of the transfer.

In short, one more reason to prefer WireTransferExchange.com: once the exchange request has been made, the figures do not change and it will be very clear how much you will have to send and how much you will receive. No hidden commissions on the transfer.

The Swiss motorway vignette

In order to drive on Swiss motorways and toll roads, it is compulsory to purchase and display the so-called vignette.

This is a sticker whose colour changes every year and which must be displayed on the vehicle to be driven in Switzerland.

There are strict guidelines as to where the sticker must be displayed. For example, for a car, on the inside of the windscreen on the left edge (driver's side) or behind the inside mirror.

This is, of course, to make it easy for police officers to check.

The vignette is compulsory on motorways and national roads of the 2nd order for all motor vehicles and trailers with a total weight of up to 3.5 tonnes.

But where do you buy it? Directly at customs, or at motorway service stations, various automobile clubs, border petrol stations and at the Swiss post office.

The cost? As in previous years, still 40 CHF (about 36-37 euro) for one year's validity. There are no vignettes with different durations, as in Austria for example.

The vignette is valid until 31 January of the year following the year of purchase. So, for example, the 2021 sticker is valid until 31 January 2022.

More information on the official federal website: https://www.ch.ch/en/travel-and-emigrate/holidays-in-switzerland/motorway-vignette/

Yes, it is possible to apply for a mortgage in Switzerland to buy a house in Italy. It is often convenient, in fact, to obtain a mortgage in Francs because the rates offered to customers have been lower for years: for those with an income in Francs, a frontier worker, there is a saving and it is not despicable. Those with an income in euros, on the other hand, will find no particular advantage in applying for a mortgage in Switzerland, precisely because of the exchange rate.

Obviously not all banks grant this: often it is the branches located in the border area that have experience in this field and are therefore able to offer mortgages even to frontier workers. These mortgages are obviously granted in Swiss francs and will charge interest rates in francs: it is therefore essential to find out about the franc/euro exchange rate in order to assess whether it is really worth applying for a mortgage in Swiss currency.

It is also necessary to reason about the maximum capital granted, the interest rate, the amortisation schedule and exposure to the EUR/CHF exchange rate. It is always advisable to obtain preliminary advice from an accounting and tax consultant.

Why choose Wiretransferexchange.com?

With Wiretransferexchange.com you change your money, salary or savings from the comfort of home and save up to 80% compared to the average rates of traditional banks and exchanges. Find out why it makes sense to change with us if you are a cross-border commuter, resident in Switzerland or a company.

Register now