Currency Exchange Glossary

Appreciation

Increase in value recorded by the currency of one country compared to the currency of another country.

Ask price

The ask price is the price at which the dealer is willing to sell a financial instrument. For those trading in the markets, it is the price at which you can buy a financial instrument at a given moment.

Balance of payments

Statistical-accounting document that records the exchange of goods and services with foreign countries, primary income (cross-border flows of labor and capital income), secondary income (current transfers), capital transfers, and capital movements (financial account) during a certain period of time. Switzerland's balance of payments, compiled by the Swiss National Bank (SNB), consists of three sections: the current account, capital transfers, and financial account.

Bank transfer

A bank transfer is a banking operation in which a sum of money is transferred from one individual or legal entity (the payer) to another (the beneficiary). It is usually completed by debiting and crediting the money to their respective current accounts. It is done by providing the beneficiary's bank details and account number. It can be free of charge or subject to a fee.

Banknote

Paper currency printed and put into circulation by the central bank of each country or union of countries.

Beneficial owner

Economically entitled is a phrase that expresses the same concept as the term "Beneficiary in fact" (or economic beneficiary) as defined in this glossary.

Beneficiary

In the case of bank transfers, it is normally the one who receives the transaction in their account, whether it is with a bank or another payment service provider.

Beneficiary in fact or Economic beneficiary

By "beneficiary in fact" (or economic beneficiary), we mean an individual or entity that enjoys the economic benefits and rights associated with the ownership of a financial asset, such as stocks, bonds, or other investments, even if the legal title or ownership of the asset may be held by another party, typically a nominee or custodian. The beneficiary in fact is the party that ultimately controls and receives the income, dividends, interest, or capital gains generated by the asset.

Bid price

The bid price (denaro) is the price at which the dealer is willing to buy a financial instrument. For those trading in the markets, it is the price at which you can sell a financial instrument at a given moment.

Border zones

Border areas or border zones, are considered to be the regions designated as such in agreements on cross-border workers concluded by Switzerland with neighboring states.

Broker

A broker is a person or company that undertakes financial transactions on behalf of third parties. This professional deals with various types of investments, such as shares, currency exchanges (forex), real estate and insurance. He usually charges a commission for each transaction. Some brokers offer advice and provide market information, suggesting which investments might be most profitable to buy or sell. This may vary depending on whether they are a complete broker or are limited to the execution of orders. However, it is important to emphasise that a broker can only give advice and make financial transactions on behalf of others after having obtained the explicit consent of the client.

Carry Trade

A strategy that involves borrowing a currency with a low interest rate and investing in a currency with a higher interest rate, earning the Swap. An example of a cross used for the Carry Trade strategy is EUR/TRY, Euro against Turkish Lira. By incurring debt in Euros and buying Turkish Lira, a favorable Swap to the trader is obtained.

Cash

Cash money refers to the means of payment consisting of coins and banknotes, which is universally and mandatorily accepted. Carrying large amounts of banknotes or coins can expose one to the risk of loss or theft. Unlike other payment methods, cash does not have systems to verify ownership, and it cannot be blocked after a theft.

Central bank

A financial institution that serves as the monetary authority of a country or a monetary union. Central banks aim to maintain price stability and support employment and economic growth through the control of interest rates and the regulation of the money supply by issuing the national currency. Examples of central banks include the Federal Reserve (Fed) of the United States, the European Central Bank (ECB) for the eurozone, and the Swiss National Bank (SNB) for Switzerland.

CFD - Contracts for difference

Contracts for Difference (CFDs) are derivative financial instruments used by traders to speculate on the price changes of an underlying asset. CFDs offer the possibility to profit (or lose money) from both the rises and falls in the prices of the underlying assets. CFDs can replicate the price of any financial instrument, known as the underlying, including stocks, indices, commodities, currencies (hence, CFDs on

Commission

Commission is a transaction cost related to the initiation, execution, and monitoring of commercial transactions. Every commercial transaction involves transaction costs for both the seller and the buyer. In the case of currency exchange, the commission can be fixed or a percentage of the transaction value.

Commodity

A commodity is a standardized and fungible good, meaning it is equivalent and interchangeable with another of the same type, regardless of the producer or specific characteristics. Commodities are typically divided into “hard commodities” and “soft commodities”. Hard commodities include extracted natural resources, such as gold, silver, oil, and natural gas. Soft commodities refer to agricultural products like wheat, coffee, sugar, and cotton.

Cross-border worker

Cross-border workers are foreign residents in the foreign border area who carry out gainful activities within the Swiss border area.

Currency

Currency is a generic term used to refer to the coins in circulation and the fiduciary instruments that represent them. It is mostly used with attributes like national or foreign, for example. It serves as a medium of exchange for goods and/or services and as a common measure of values.

Currency conversion

The term "currency conversion" is synonymous with "currency exchange", as described in this glossary.

Currency converter

A currency converter is a tool that allows you to check at any time the exchange rates for currencies from around the world. Normally, the displayed data is in real-time.

Currency Exchange

Currency exchange is the operation of converting an amount of money from one national currency to another, based on the Forex market exchange rates. Currency exchange transactions are essential for international trade and investments. Banks, brokers, exchange houses, and other intermediaries facilitate these transactions, often applying a commission in cash or increasing the spread on the exchange rate.

Currency intervention

The purchase or sale of national currency against one or more foreign currencies by a central bank with the intention of strengthening or weakening its own currency and influencing the exchange rate.

Currency Market

The currency market is synonymous with the Forex market, an acronym for Foreign Exchange.

Currency pair or Cross

A "Currency Pair", also known as a “cross” or currency pair, represents the quotation of one currency against another. The currency pair indicates how much the base currency (the first currency) is worth in terms of the quote currency (the second currency, or “quote currency”). For example, in the EUR/CHF pair, the EUR is the base currency and the Swiss Franc is the quote currency. The price indicates how many Swiss Francs are needed to purchase one Euro (real-time EUR/CHF exchange rate).

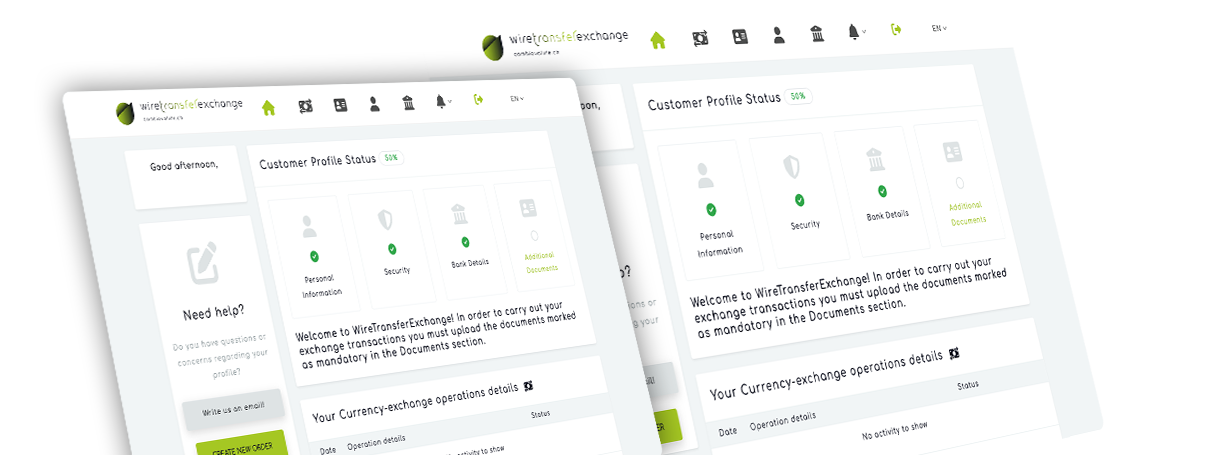

Customer profile

The customer profile is a summary document that contains all the personal and financial data of a client or counterparty of a financial intermediary.

Dealer

A Dealer is a person or company that buys and sells securities on its own account, either directly or through an intermediary. The dealer acts as a principal in trading on his own account, unlike a broker who acts as an order-executing agent on behalf of his clients. Dealers are important figures in the market as they help create liquidity in the financial markets. They place orders in the market, underwrite securities and provide investment services to investors. This means that dealers are the market makers who provide the bid and ask quotes you see when you look up the price of a security in the over-the-counter market.

Dealer

is a person or company that buys and sells securities on its own account, either directly or through an intermediary. The dealer acts as a principal in trading on his own account, unlike a broker who acts as an order-executing agent on behalf of his clients. Dealers are important figures in the market as they help create liquidity in the financial markets. They place orders in the market, underwrite securities and provide investment services to investors. This means that dealers are the market makers who provide the bid and ask quotes you see when you look up the price of a security in the over-the-counter market.

Depreciation

Currency depreciation refers to the decrease in value of a country's currency compared to the currency of another country.

Exchange

Currency exchange is the operation of converting (or swapping) a certain number of units of currency into another currency. The exchange rate is the ratio at which one currency can be exchanged for another, and it depends on the market value of the currencies in the international market.

Exchange rate

The exchange rate is the ratio at which one currency can be exchanged for another. It depends on the market value of currencies in the international market.

Fiduciary Services Act

The Federal Act on the Exercise of Fiduciary Professions is a Swiss federal law designed to regulate and discipline the exercise of fiduciary professions (money changers, trust accountants, real estate trustees) in Switzerland.

Financial intermediary

A financial intermediary is a business that engages in the professional provision of financial or investment services to the public. The category of Financial Intermediaries includes banks, trust companies, stockbrokers, securities dealers, asset management companies, and investment companies.

Financial Services Act

The Swiss Federal Act on Financial Services (FinSA) is a Swiss law that contains regulations for the provision of financial services and financial instruments, customer protection, and the creation of uniform competitive conditions for financial intermediaries.

FINMA

The Swiss Financial Market Supervisory Authority (FINMA) is responsible for the supervision of banks, insurance companies, stock exchanges, securities dealers, collective investment schemes, and insurance intermediaries. As an independent supervisory authority, its objective is to protect creditors, investors, and policyholders, as well as to safeguard the functioning of financial markets.

Foreign currency

Foreign currency is the currency that has legal tender in a specific foreign country or state and is used in international trade.

Forex

The foreign exchange market (Forex or FX) is the term that identifies the global electronic market for the trading of international currencies and currency derivatives. It has no physical location but is the largest and most liquid market in the world, with trillions traded daily.

Form A

Form A is the form in which a client/counterparty of a financial intermediary specifies the economically entitled party to the equity securities handled during the business relationship. It is used when the client/counterparty is an individual.

Form K

Form K is the form in which a client/counterparty of a financial intermediary specifies the controlling party for unlisted legal entities and partnerships entering into a business relationship with the financial intermediary.

Forward exchange transaction

A forward foreign exchange transaction is a foreign exchange operation that involves the exchange of two currencies on a future date at a predetermined exchange rate at the time of the transaction.

Free currency

A freely convertible currency is a national currency for which the use in international transactions is allowed and regulated.

Fundamental Analysis

A method of evaluating a financial instrument (a stock, a currency, or a commodity) through the economic and financial examination of the underlying assets. It is based on identifying the intrinsic value of an investment by analyzing, for example, data from company financial statements such as earnings, revenue, debt, and the general economic conditions of that market. Analysts use indicators such as the price/earnings (P/E) ratio, dividend yield, earnings growth, and other financial data to make long-term investment decisions.

Hedging

Also known as a "hedging strategy," it is a technique used by traders or investors to reduce or neutralize the risk of adverse price movements in their investments. It is achieved by purchasing financial instruments that are uncorrelated with the investment they wish to "hedge." The goal of hedging is not to make a profit, but rather to limit losses.

Inflation rate

A prolonged increase in the general price level, which corresponds to a loss of purchasing power of the currency,.

Institutional client

Institutional clientele typically refers to: banks, insurance companies, central banks, national or supranational public entities.

Interbank exchange rate

Exchange price at which banks and other financial institutions exchange currencies with each other. This rate is used as a benchmark for international financial transactions and represents the relative reference value of one currency against another at a given point in time.

Banks use the interbank exchange rate as a basis for determining the exchange rates they offer their customers. It is important to note that the interbank exchange rate may differ from the exchange rates offered to the public, as banks often charge fees or margins to cover costs and make a profit on currency transactions. On the foreign exchange market, the interbank rate can thus be defined as a 'wholesale' price, usually valid for transactions of EUR 100,000 or more or equivalent.

Lloyd's Insurance

Lloyd's Insurance commonly known as Lloyd's, is a British insurance corporation that originated in the late 17th century, located in the heart of the financial district of the City of London. Initially, shipowners and businessmen gathered at the café of Edward Lloyd, known as Lloyd's Coffee House, located near the River Thames in London, to insure his ships. Today, it is recognized as one of the most important global insurance markets and commonly identified as "The Lloyd's". The Lloyd's company does not underwrite insurance policies directly but entrusts this responsibility to its members. It operates as a market regulator establishing guidelines under which members can operate and provide centralized services to other affiliated operators. The key players at Lloyd's can be divided into two categories: the members, known as underwriters, who provide the capital, and the agents, brokers and other professionals who assist members, assess risks and represent external clients.

Major

The term refers to the most traded and liquid currency pairs. These pairs always include the United States dollar (USD) on one side and one of the other major world currencies on the other. List of currency pairs considered Majors:

- EUR/USD (Euro/United States dollar)

- USD/JPY (United States dollar/Japanese yen)

- GBP/USD (British pound sterling/United States dollar)

- USD/CHF (United States dollar/Swiss franc)

- AUD/USD (Australian dollar/United States dollar)

- USD/CAD (United States dollar/Canadian dollar)

- NZD/USD (New Zealand dollar/United States dollar)

Margin Call

Regarding leveraged trading, in the situation where the trader (the investor) holds an open position and is at a loss, a Margin Call is the request to deposit money, made by the broker to the client, in order to increase the margin (the collateral guarantee) to maintain an open position and avoid the automatic closure of the position. If new funds are not deposited following a margin call request, the broker may liquidate the client's position to recover the loan.

Market Liquidity

The ability of an asset to be bought or sold in the market without causing a significant price change. In other words, in the foreign exchange market, liquidity indicates how easily currencies can be traded without affecting their market value. Liquidity also signifies the ease of finding a counterparty for buying or selling an asset. The Forex market is considered among the most liquid due to the size of the market itself, the large number of market participants, and the high volumes. The liquidity of a financial instrument affects the speed at which an order can be executed, price stability, and the spread.

Market maker

A market maker is a financial intermediary that participates in one or more markets (currency,, stocks, commodities, etc.) by ensuring the ability for investors to trade financial instruments at a fair price. Normally, a market maker purchases financial instruments from those who want to sell them and resells the same financial instruments to those who want to buy them.

Mark-up

The mark-up, or markup, applied by any dealer in goods and services corresponds to the amount added to the cost of the goods/services offered to cover overhead expenses and generate a profit. In the case of a currency conversion service, it corresponds to a percentage added to the exchange rate offered to customers.

Money changer

A Money Changer or Currency Exchange Operator is a person who professionally engages in the currency exchange activity to make a profit.

Money Laundering Act

The Federal Act on Combating Money Laundering and Terrorist Financing (AML), also known as the Federal Act on Combating Money Laundering and Terrorist Financing, is a Swiss federal law designed to combat money laundering by requiring financial intermediaries to be vigilant about the origin of the funds they handle.

MTF- Multilateral Trading Facility

An MTF, or Multilateral Trading Facility, enables the matching of supply and demand for financial instruments by multiple interested parties. MTFs offer an alternative to traditional stock exchanges, allowing for the trading of a broader range of financial products, including stocks, bonds, funds, certificates, and derivatives.

National currency

The national currency is the legal tender in a specific state.

OTP (one-time password)

OTP (One-Time Password) is an authentication service designed to protect your payments and online transactions.

Over-the-counter

An OTC (Over-the-Counter) transaction refers to a trade or transaction that occurs directly between two parties, often facilitated by a dealer network rather than through a centralized exchange. In an OTC trade, the buying and selling of financial instruments, such as stocks, bonds, commodities, or derivatives, take place directly between the buyer and the seller, outside the scope of a formal exchange.

These transactions are typically conducted electronically or via phone and are characterized by being less regulated compared to trades that occur on formal exchanges. OTC transactions offer flexibility in terms of negotiation, pricing, and contract terms, but they may also involve higher risks due to the lack of transparency and standardized regulations compared to exchange-traded transactions.

PIP

PIP is the abbreviation for "Percentage in Point" and represents a unit of measurement used in the Forex market to express a change in value between two currencies. For most currency pairs, a pip is equivalent to a movement of one unit of the fourth decimal place "0.0001". For example, if EUR/CHF moves from 1.07 to 1.0701, it is said to have increased by one pip.

Private client

Private clientele is defined as the customer segment that cannot be classified as professional clientele. Essentially, it consists of ordinary savers who turn to financial intermediaries to make their investments or to receive financial services.

Professional client

A professional client is an entity that possesses the experience, knowledge, and expertise necessary to make informed investment decisions and evaluate the risks they undertake. This category normally includes legal entities but also individuals under certain conditions.

Quotations

Quotations refer to the most recent selling price of a stock, bond, or any other traded asset, such as currencies.

SARON rate

The Guaranteed Overnight Credit Rate, acronym SARON (Swiss Average Rate Overnight), is part of the Swiss Reference Rates. It is based on the most liquid segment of the Swiss franc money market and is calculated using actual transactions and binding quotes from the interbank market for repo transactions. SARON is administered by SIX Index SA. In recent years, it has gained increasing importance as a reference rate.

Self-regulatory organizations (SROs)

SROs are the so-called Self-Regulatory Bodies. They are private law bodies responsible for supervising the activities of Swiss financial intermediaries and ensuring that they meet the diligence obligations stemming from the Anti-Money Laundering Act (AML).

Sender (ordering party)

In the case of bank transfers, it is usually the one who gives the order to transfer a certain sum of money to their bank or payment service provider, in favor of a third party, the so-called recipient.

SEPA Area - Single Euro Payments Area

The Single Euro Payments Area (SEPA) is a zone of integration and standardisation of payments within the European Union concerning bank payments denominated in euros. It includes the 27 member states of the European Union, the four member states of the European Free Trade Association (Iceland, Liechtenstein, Norway, and Switzerland), and the United Kingdom. Andorra, Monaco, San Marino, and Vatican City also participate.

SEPA Instant payment

SEPA Instant payment, or more precisely, SEPA Instant credit transfer, is a type of electronic money transfer available within the SEPA area. It is available 24 hours a day, 7 days a week, and takes no more than 10 seconds for the receiving payment service provider (PSP) to receive it and make it available to its customer.

SEPA payment

The payment or SEPA transfer is a tool with which you can transfer a sum of money, typically from one bank account to another within the SEPA area.

Single Euro Payments Area (SEPA)

SEPA (Single Euro Payments Area) is an area where all euro-denominated transactions will be conducted with consistent technical standards, transparent and guaranteed service levels, and pricing criteria. The SEPA area includes the 27 European Union countries, as well as Iceland, Liechtenstein, Norway, and Switzerland. The payment instruments within the SEPA area are and will be bank transfers, direct debits, electronic money, and cash. Checks are excluded.

Spot exchange transaction

A spot foreign exchange transaction is a foreign exchange operation involving the immediate exchange of two currencies at the current exchange rate.

Spread

In trading, the spread is the difference between the buying price (ask) and the selling price (bid) quoted by the market. It is an essential element for currency trading because it determines the price that will be offered to customers.

Stock exchange

An organized and centralized market where financial instruments such as stocks, bonds, and derivatives are traded. An exchange is a platform that facilitates the meeting between demand and supply of securities, allowing listed companies to raise capital and investors to buy or sell shares. Stock exchanges play a fundamental role in modern capitalist economies, providing liquidity to markets. Stock exchanges are regulated by national or international supervisory authorities, which establish rules and regulations to ensure transparency, fairness, and investor protection. Examples of stock exchanges include the SIX Swiss Exchange, the New York Stock Exchange (NYSE) and the Milan Stock Exchange. Note: OTC instruments, such as currencies (Forex) or CFDs, are not traded on stock exchanges; instead, they are traded between private individuals or through decentralized platforms.

Stop Loss

An automatic order to close a position, set by the trader, in order to limit the potential losses of a financial transaction. The stop loss allows setting in advance the maximum acceptable loss on an open position. Once the stop loss price is reached, the sell order is automatically executed, protecting the investor from further capital losses.

Strong currency

In general, a strong currency refers to that of countries with a positive balance of payments. A strong currency tends to appreciate compared to other currencies in the long term.

Swap

In the foreign exchange market (or Forex), the Swap refers to the interest rate differential between the two currencies of a transaction on the foreign exchange market. The Swap can be positive (a revenue for the trader) or negative (a cost for the trader) and is usually charged or credited by the broker to the client's account. For intraday traders, it is the interest rate paid or earned for holding an open position overnight.

Swiss Interbank Clearing (SIC) or Swiss National Payment

The Swiss Interbank Clearing (SIC) payment system is at the heart of financial transfers in Switzerland. Since its activation on 10 June 1987, its operational management has been entrusted to SIX Interbank Clearing Ltd (SIC Ltd), on behalf of the Swiss National Bank (SNB). The main entities involved in the system include local banks and other players in the financial landscape. In addition to handling large transactions, SIC also settles smaller payments, such as fund transfers for financial services (credit transfers, card transactions, direct debits, and the like). Since its launch, the SIC system has grown in importance, both in terms of transaction volume and settled value, becoming a fundamental pillar of the Swiss financial system.

Swiss National Bank (SNB)

The SNB was founded on the basis of the Federal Act on the Swiss National Bank, which entered into force on 16 January 1906. It opened for business on 20 June 1907. The SNB is a joint-stock company governed by special provisions under federal law. It is administered with the cooperation and under the supervision of the Confederation in accordance with the provisions of the National Bank Act (NBA). Its shares are registered and listed on the stock exchange. The share capital amounts to CHF 25 million, approximately 55% of which is held by public shareholders (cantons, cantonal banks, etc.). The remaining shares are largely in the hands of private persons. The Confederation does not hold any shares. The Swiss National Bank (SNB) operates as Switzerland's independent central bank, with its primary goal being to ensure price stability while also taking economic developments into account. The SNB conducts its monetary policy by setting the SNB policy rate to influence short-term Swiss franc money market rates and intervenes in the foreign exchange market as necessary. It is responsible for the supply and distribution of banknotes, oversight of cashless payment transactions, management of currency reserves, contribution to the stability of the financial system, international monetary cooperation, offering services to the Confederation, collecting statistical data, and conducting research relevant to its mandates. For more detailed information, you can visit their official website: SNB Mandates and Goals.

Swiss National Bank (SNB) policy rate

The interest rate that the National Bank sets for the implementation of its monetary policy, aiming to keep short-term rates on secured money market loans in Swiss francs close to it. Among these, the most significant today is SARON.

Technical Analysis

The study of charts, historical prices, and trading volumes of a financial instrument with the aim of predicting future movements. It assumes that price movements follow trends and that historical patterns tend to repeat themselves. Technical analysts use moving averages, chart patterns, and support and resistance levels to identify favorable moments for buying or selling a specific financial instrument. Unlike fundamental analysis, technical analysis focuses exclusively on price and volume, presupposing that these contain all necessary information (a theory that comes from the famous saying "The market discounts everything").

Tick

In the currency market, a "tick" represents the minimum representable movement of a financial instrument. With reference to Forex, a tick is thus the smallest price change that a currency pair can record and varies from one market to another. The value of a tick depends on the currency pair traded. For example, for most currency pairs, a tick equals a 0.0001 change in price (i.e., one PIP). For currency pairs that include the Japanese yen, a tick generally equals a 0.01 change.

Value date

The value date in financial transactions indicates the day when the sums will actually be available to the beneficiary of each transaction. It is important because, for example, if the balance of a current account is positive on a value date, the account holder can use those funds on the same day. In financial markets, it is common for the indicated value date to be one or more days after the contract is signed or the transaction is authorized.

Volatility

In the foreign exchange market, it refers to the range of price changes in currency exchange rates over a specific period of time. It is an indicator of price variability and can be measured using various indicators including standard deviation, the measurement of lows and highs, or through specific tools like the Average True Range (ATR). The volatility of a currency pair in the forex market is determined by numerous factors, including economic events, potential political, social, or financial crises, as well as seasonal factors such as trading hours.

Weak currency

A weak currency, is typically a currency that experiences frequent fluctuations in its value compared to other currencies and tends to devalue over the long term. This long-term devaluation is often attributed to deficits in the balance of payments of the country or countries associated with that currency.

Why choose Wiretransferexchange.com?

With Wiretransferexchange.com you change your money, salary or savings from the comfort of home and save up to 80% compared to the average rates of traditional banks and exchanges. Find out why it makes sense to change with us if you are a cross-border commuter, resident in Switzerland or a company.

Register now